Governments and regulatory bodies worldwide have been tightening their grip on financial markets in response to economic crises. There's also the need to prevent money laundering, fraud, and other financial crimes. As a result, financial institutions are subject to many regulations, including Anti-Money Laundering (AML) laws, Know Your Customer (KYC) requirements, data protection regulations, and various industry-specific rules.

These regulations are often complex, with overlapping requirements, and can vary significantly from one jurisdiction to another. Keeping up with these ever-changing requirements is a daunting task for financial institutions. Fortunately, law firms can step in to provide crucial support.

The Regulatory Challenge

In some cases, the constantly changing regulatory framework causes overlap, posing a regulatory challenge best resolved by lawyers.

Regulatory overlap refers to using several laws and policies to address a common market issue. The Government Accountability Office (GAO) further defines regulatory overlap by looking at how extensively the jurisdictions of government agencies interconnect.

An overlap occurs when several agencies with similar roles and goals have the same regulatory activities to regulate similar businesses. For example, the Federal Reserve Board (the Fed) oversees banks and bank holding companies as required by the Federal Reserve Act of 1913. However, the Federal Deposit Insurance Corporation (FDIC), established by the Banking Act of 1933, has the same role.

Fragmentation happens when more than one federal agency or more than one organization in a federal agency is responsible for the same policy area. For example, the Federal Bureau of Investigation (FBI), Federal Deposit Insurance Corporation (FDIC), Financial Crimes Enforcement Network (FinCEN), Government Accountability Office (GAO), Internal Revenue Service Criminal Investigations (IRS-CI), and Office of Foreign Asset Control (OFAC) are all responsible for enforcing the Bank Secrecy Act (BSA).

Duplication happens when different regulators engage in the same activities overseeing the same establishments. For example, the same agencies collect data on the same financial institutions to determine their soundness.

Problems Caused by Regulatory Overlap to Financial Institutions

Regulatory overlap may seem like a thorough way of sealing legal loopholes. However, it presents a problematic and costly problem for financial institutions.

1. Increased Compliance Costs

93.9 percent of regulatory compliance costs in the U.S. financial sector are labor-related, and 3.3 percent are physical capital-related. Spending on outside advisers accounts for only 2.8 percent of compliance costs.

The constantly changing regulations and regulatory overlap have forced financial institutions to increase their budget on outside advisers. They now hire compliance consultants to keep up with the changing needs. After all, non-compliance is more expensive, causing a loss of money in penalties and customers due to reputation damage. These entities also risk criminal and civil charges.

2. Slow Entry into the Market

Compliance needs for different levels of government, such as federal, state, and local, are barriers to entry into the market. Financial institutions need more time and money to begin operations and prove profitable to their shareholders.

3. Regulatory Delays

"We'll take it from here." Such statements don't only apply to crime scenes with disagreements on an agency's or department's jurisdiction. It also happens in financial markets, where agents disagree on the boundaries of their jurisdictions.

In other cases, there's a need to wait for other interested and relevant agencies to create the rules of engagement before financial institutions get approval. Experienced compliance consultants are essential in figuring out the landscape.

4. Policy Uncertainty

Conflict between regulatory agencies brings a new challenge—policy uncertainty. It may be overwhelming for financial institutions to wade these murky waters. Law firms help interpret the law and guide the right course of action.

5. Reduced Competitiveness

Financial institutions operating internationally may experience reduced competitiveness when competing against foreign firms that aren't subjected to the same compliance challenges.

How Law Firms Are Harnessing Compliance Consulting

Law firms solve these problems by harnessing compliance consulting, offering specific services and software that save them time and money. These services help financial institutions quickly understand the latest regulations, recognize how these changes affect their businesses, and implement the complex mandatory changes. Also, law firms help establish links with the necessary agencies and self-audit on non-compliance vulnerabilities.

Commonly, law firms focus on:

- Transaction reporting regulations

- Transaction reporting operating models

- Operational risk

- Risk and Control Assessments

- License & entity set up rules and processes

- Sustainable finance law, although participation is currently voluntary in the USA.

- Regulatory issue analysis and roadmaps

- Data protection regulations

- Trading and market issues

- Consumer protection concerning financial products. It helps to comply with the requirements of the Federal Reserve System (FED), Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), National Credit Union Administration (NCUA), state banking regulators, the Federal Trade Commission (FTC), and the Consumer Financial Protection Bureau (CFPB), among others.

- International regulations. For example, the European Securities and Markets Authority (ESMA), General Data Protection Regulations (GDPR), and Markets in Financial Instruments Directive (MiFID) are for financial institutions operating in Europe.

- Insight into future financial regulations

Who Needs Compliance Consulting Services?

All entities in the financial services market need to contract the services of a compliance consultant. These businesses include, but are not limited to:

- Money Services Businesses (MSBs)

- Banks

- Credit unions

- Insurance companies

- Securities/capital markets

How to Get Started

Finding the right law firm may also be challenging for financial institutions. Despite being in the same market, each financial entity is unique in certain ways. Therefore, a law firm well-suited for a business' specific needs is vital.

Here are a few tips on finding the right law firm for compliance consulting.

Ask for referrals.

Ask for referrals from trusted and respected people such as friends, family, colleagues, business associates, and trade associations. A law firm may be within your budget, but your top priorities are service delivery and customer satisfaction.

Information from referrals helps financial institution managers make informed decisions. You also get first-hand information on issues a direct chat with the law firm may not reveal until you experience the problems well into the partnership. And that may be too late if the contract doesn't have a convenient opt-out process.

Find out the law firm's reputation.

Referrals help remove doubt. However, financial institutions must perform due diligence and seek online and offline reviews from other customers. Researching prospective law firms online is an excellent way to start.

Check for any customer complaints, news coverage, court cases, and information provided on their website. Negative reviews or news may be detrimental to potential law firms. However, seeing how they respond to criticism may offer positive information. After all, setbacks are common in businesses. How businesses respond to these issues matters.

Work within your budget.

Ensure the law firm of choice is within budget and offers value. Create a list of probable law firms that meet your requirements, understand their pros and cons, and how well they fit into your budget. Take note of hidden charges, complementary services, and any valuable linkages. For instance, a slightly more expensive law firm that gives complimentary access to automated tracking technology on compliance software is better than a cheaper firm that'll need you to pay full rates for the same technology.

Assess the responsiveness of the assigned lawyer.

Law firms employ a robust staff of expert lawyers to handle all their clients. Consequently, individual lawyers attached to a financial institution are instrumental links between the two entities—the law firm and the financial institution.

So, it's crucial to assess the lawyer's responsiveness to issues, problem-solving abilities, communication skills, attention to detail, and other soft and hard skills that improve service delivery.

Have a list of non-negotiables.

Indeed, there's no perfect fit in business. So, enterprises compromise on a few issues that they can overlook. That's why financial institutions must have a strict policy on non-negotiables penned into the contract.

Common mistakes that would cause serious non-compliance vulnerabilities and costs should top the list—for example, negligence. MSBs that don't need to report transfers of more than 10 percent of their voting power or equity interest to the Securities and Exchange Commission (SEC) are required to re-register. Re-registration must happen within 180 days of these changes. A good lawyer should notify you when you discuss an equity transfer. They should prepare and submit the necessary documents for re-registration within the legal period. Otherwise, you risk losing up to $5,000 as a civil penalty.

Hiring Compliance Consultants Is Smart

Financial institutions are overwhelmed by the complex, changing, and overlapping regulations that govern their business. Keeping up wastes time and resources trying to understand these changes. It wastes precious time, affecting service delivery. Silicon Valley companies like Captain Compliance are offering both data privacy and compliance services that are saving corporations hundreds of thousands of dollars a year. Other software companies like Vanta & Drata are making SOC 2 and ISO certifications simplified.

Failure to understand these changes can expose a business to risks, including penalties, reputation damage, criminal charges, and civil charges for non-compliance. So, hiring a law firm for compliance consulting services is a smart choice.

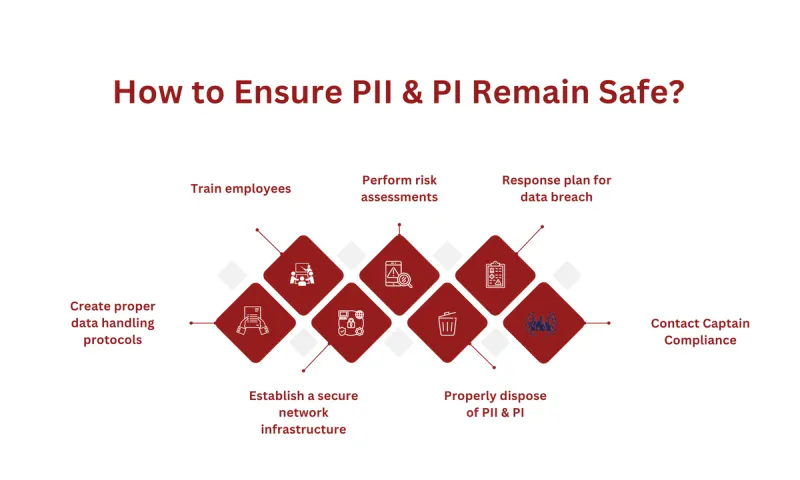

Expect services such as operation risk assessments, licensing, setting up, and data protection measures. You'll need to take careful steps before settling on a law firm. Ask for referrals, conduct online research on shortlisted firms, and consider your budget and their value proposition. Assess the assigned lawyer to your firm, and have a policy of non-negotiables within the contract.